Across the summer, I wrote a series on Capital Valuation.

Today, I focus on the US. You can apply this framework to markets all around the world. Even more so, because other countries have far less fixed rate debt than Americans.

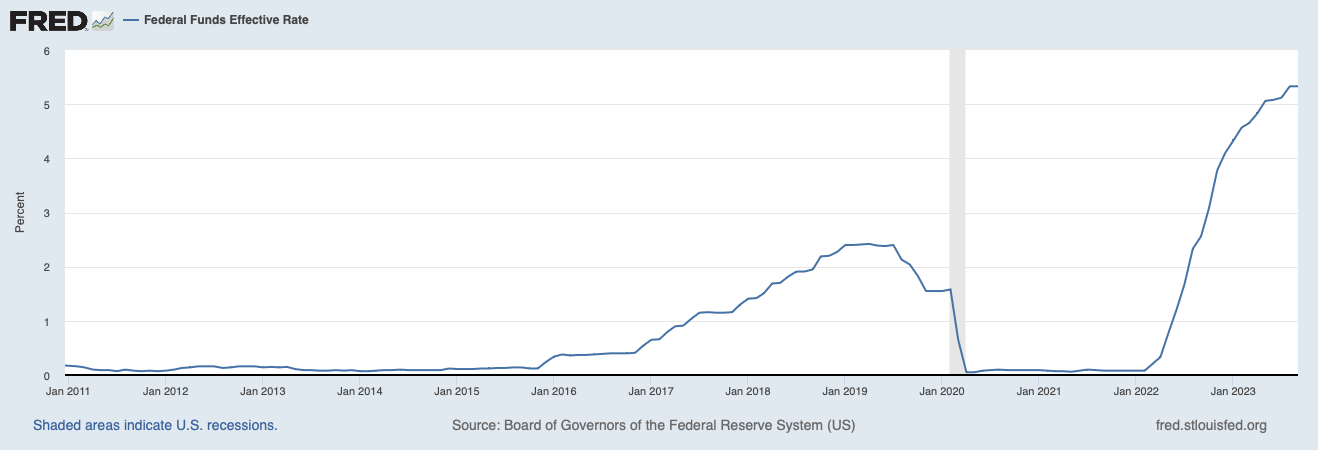

Since my summer series, rates have shifted further.

Despite a major increase in the price of money, asset values are holding up.

Why might that be?

It’s still early days. Looking at the various charts (above), we’re a little over halfway through the three-years it takes people to change memories and expectations.

Against this interest rate backdrop, my friends at the top of financial society continue to roll strong. 2023 has been an absolutely banner year for one of my high-end realtor pals.

In Spring 2022, we thought rate increases would crater things.

We were wrong:

About the strength of the market, and

The size of the rate increases.

Values have held up, despite rates being higher than expected.

Whenever I’m surprised, I pause.

Some things I’m thinking about:

At what yield does a return to bonds make sense?

What might 10% mortgage rates do to my financial life?

Don’t have an answer, yet.

What You’ll Hear

You’re going to hear, or think, two things.

You’ll be able to refinance, later.

High-end buyers aren’t influenced by debt markets.

A lesson my mentors taught me in Private Equity is NEVER do a deal on the basis of being able to refinance.

If it doesn’t make sense in the current market then it’s overpriced, period.

Always treat the ability to refinance as a possible source of extra return, not a fundamental part of the deal.

My mentors learned this in the late-80s when they underwrote a large buyout and the debt markets closed before they could syndicate. These can be career ending decisions.

20 years later (2005-2008), “teaser rate” loans were used to get retail buyers into deals that didn’t make sense.

Today, people are taking 8% mortgages with a hope that rates will return to the level seen in the recent past.

They could be right.

The key thing for you to consider… What If They Are Wrong?

Other things you might tell yourself…

This asset class isn’t impacted by debt markets, or

This segment of the market is all cash buyers…

Therefore, the price of debt doesn’t matter.

Wrong.

Prices move at the margin and the marginal buyer is highly influenced by the price of money.

It’s easy to ignore this reality when prices are rising. We often misattribute the rise to investment acumen and judgement (and ignore trillions of easy money entering the economy).

The reality of tight money can hit hard.

Again, we don’t know what the future holds. What we can do is consider the impact of tight money persisting.

A Simple Case Study

In the summer, I shared a story about my neighbor placing his house on the market.

It is a very nice house and was bought by a family from California.

Purchase Price was $3.3 million.

At 5.0% => $13,750 per month

At 7.5% => $20,625 per month

At 9.0% => $24,750 per month

“Per Month” of what, you might ask. That depends on your debt structure and alternative uses of capital.

Looking at the 5% line, I know a family of three can rent a house in Boulder for half that expense. As a renter, they pay no taxes and experience no depreciation.

If they had the cash to buy a $3.3 million dollar house then:

They could create an annuity for themselves and retire.

Or, downsize, work part-time, and focus on their marriage/kids.

This is likely what my neighbor was thinking when his family downsized to a smaller town, nearby.

There is a disconnect between:

The Capital Value, and

The Yield

This disconnect is not surprising. Short-term rates have been, mostly, zero for a decade.

Zero rates have influenced the price of everything.

The Marginal Buyer & Seller

All around the world are different types of owners, buyers and sellers.

If I’m a recent empty-nester, or

A young person who wants to chase a dream…

Then the “cash out” numbers are compelling.

Even if we don’t cash out. Many owners can double their income by downsizing.

Current prices only make sense if one assumes a return to a monetary policy that required a $3 Trillion increase in Federal Reserve assets (plus massive additions elsewhere in the world).

A return to easy money is possible but I wouldn’t base family portfolio strategy on it.

When capital prices and asset yields disagree, we want to be cautious with overall strategy.

When rates were set at zero, the adjustment happened by capital values increasing and asset yields decreasing.

Now that rates have jumped, we have not see a material adjustment.

Big moves are possible. Some of these moves could have very negative impacts on balance sheets.

What To Do

Ideally, you want to create a financial life that is robust to any outcome.

Leveraged deals at current pricing have the potential to be “very wrong” in scenarios that seem possible.

Know that deals that make sense for people using Other People’s Money can be very different than what makes sense using your own money. Many of the transactions we “see” in the world are not appropriate for family wealth.

Finally, if you’re a young person then remember your greatest asset is TIME. Right behind that is EARNING CAPACITY. Education and work experience are an effective way to increase earning capacity.

Whenever my kids ask, I tell them I will fully support education that supports their capacity to earn.1

See my Kids & Money Series.