Thinking In Time

During An Era of High Multiples

In Part Three, I ended by explaining how to calculate cost-per-day-used. It’s a helpful way to look to vacation real estate.

Several times in my life, I’ve been happy I didn’t convert a luxury experience into a capital investment.

Sometimes this was because the investment opportunity was a bad idea.

More often, my life changed in ways I was unable to predict.

Thinking in terms of time can help us make better decisions for our future selves.

Let’s consider another calculation => the “years of income” implied by the capital value of an asset.

By “income,” I mean the net cash flow the asset is able to generate, or save.

We can make the calculation gross or net:

Gross Value of Asset divided by Gross Income

Net Value of Asset1 divided by Net Income

I prefer to use net cash flow and take the numbers from a tax return.

Capital Values Expressed In “Years of Income”

At the end of 2021, friends of mine sold their house.

The amount of money they took off the table was the equivalent of ~100-years worth of rental income.

They took the equivalent of a Century of rent off the table. Wow.

Their situation was special:

They downsized

They left the state

It’s a technique that only works once. If you move-out-of-town prices can rise and you may not be able to move-back-in.

Still, that 100-years of rental equivalent caught my attention. I decided to sell an investment property.

That property sold in 2022 for the equivalent of 76 years of net rental income.2

My Window of Time

Looking at assets in terms of “years” is helpful in ways you might not have considered.

I’m 55 at the end of this year.

If someone offers to buy me out at a multiple of 50 “years” then that’s attractive.3

I know I’ll be an empty nester in eight years and the capital will be useful as my life changes, again.

Likewise, as a buyer, if the entry price is approaching 100 “years” then that’s unattractive. It doesn’t make sense for me to buy and capitalize the expense.

I consider “years” in light of my family history.

My grandparents were either dead or winding down beyond their 75th birthdays. 75 is 20 years away. Closer than my 30th, which doesn’t seem that long ago.

It’s like this for everyone.

The young underestimate the power of time.

Our elders miss how much time is of the essence.

Our investing mind doesn’t understand time.

Alternatives

Faced with high multiples, many will say,

“That’s simply the market price.”

“Why interrupt compounding?”

“Why pay capital gains taxes?”

I agree and that’s why the calculation didn’t prompt action until:

I was older - I bought at 41 years old and sold at 53 years old.

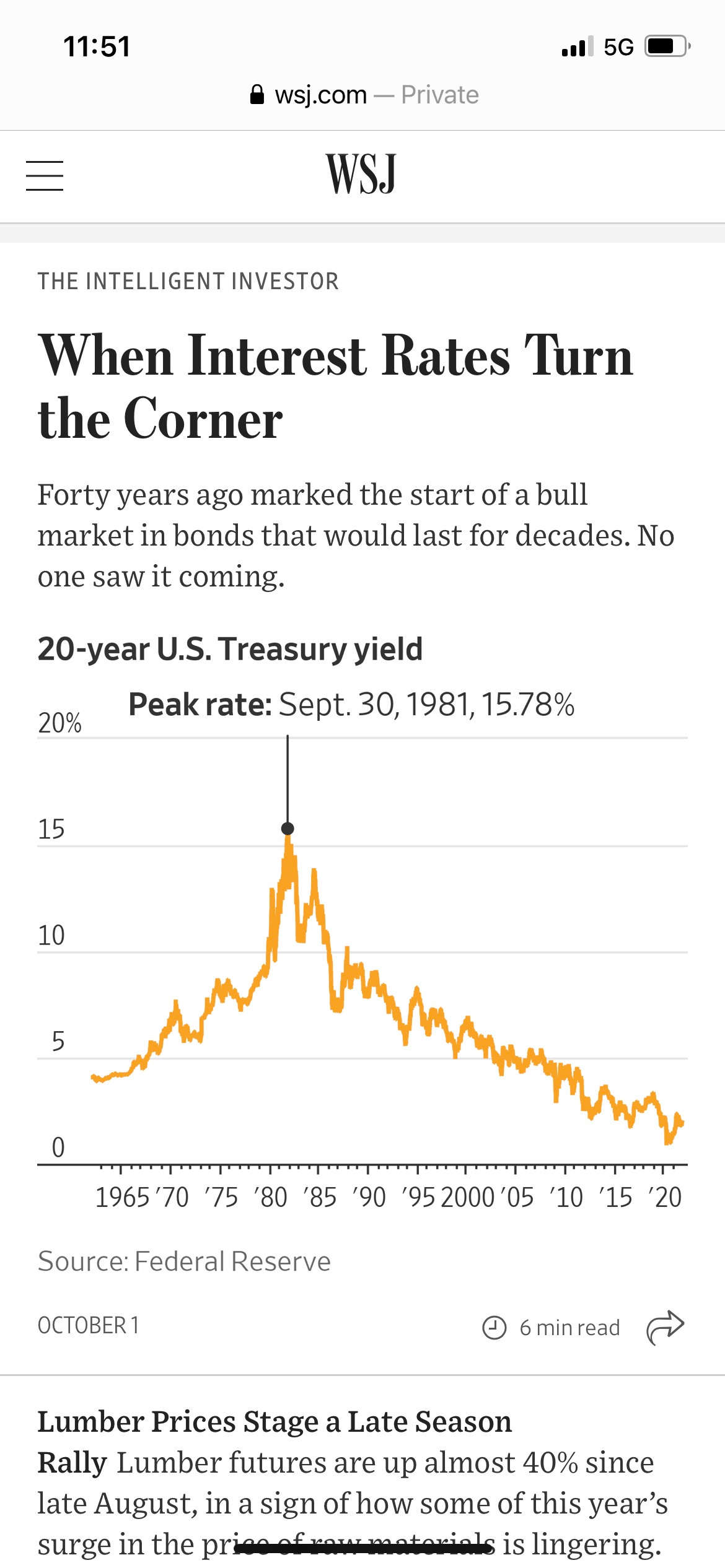

The interest rate outlook was different.

Rates impact the value of everything.

from 2010 to 2021, I compared a shrinking net yield on investment to declining yields elsewhere.

One year post-sale, my income on the net proceeds is 5x my cash flow from the sold property.4

Each of us a finite window of time in which to earn, invest, spend and enjoy our capital.

I had a look at the “years” implied in the price…

compared that to my age, and…

considered the active lifespan of my parents and grandparents.

As I’ve written elsewhere, I’d rather use the capital to spend additional TIME with my family. Particularly, as the alternative is giving unearned income to my adult children.

In case I was wrong5, the rest of my balance sheet was left unchanged.

Change slowly is an adage that has served us well.

On The Buy Side

The buy-side consideration is equally important.

The market continues to offer real estate deals at 50-100 years-equivalent pricing. I look at those deals…

I See… one more thing to take care of => costing me time and emotion.

I Ask… is there another way to generate happiness/status for my family?

I Remember… a bad deal costs a minimum of 10% of purchase price.

I Know… each new decision creates an opportunity for error to enter my life.

Smart tactical spending can yield a better returns than large capital investments.

…particularly, in times when interest rates sit on a rising trend line.

Net After Tax Realizable Value: Value of Asset, Less Agent’s & Closing Fees, Less Federal/State Capital Gains Taxes.

2022 cash proceeds after tax “divided by” 2021 net cash flow.

If you are under 30 then know your greatest asset is TIME. Where a young person invests time dominates outcome more than asset allocation.

Take time to calculate the risk free return on equity you have sitting in your portfolio. Pay particular attention to non- and negative-yielding assets. You only need to achieve financial security once.

A “wrong” decision in the sense that… capital values race ahead further, purchasing power is eroded by inflation and/or I live far longer than my ancestors.