In my article on Price & Yield, I spoke of the disconnect between capital values and the price of money. Given the difference, homeowners are considering:

Locking in gains (sell then rent)

Shifting to a debt-free position (downsize)

If that’s you then a bit of homework before pulling the trigger on a change in strategy…

What’s The Cost To Go Variable?

Current position - Have a look at your mortgage, taxes and insurance.

If you’re a homeowner with a low-cost mortgage then then you might not save much from selling.

A good test is to look at your net position if you:

Moved out of your existing place.

Rented it to someone else.

Downsized into a rental.

Once you factor in the time, emotion and expense of being a landlord… is there anything in it?

Not saying you should, or should not, take this option. Simply that there will be information for your family by running-the-numbers.

Debt-Free Living

What if I sold, downsized and lived debt-free?

Debt-free is an attractive position. I can see how it might appeal.

Again, compare “current cost of living” to “cost to rent/acquire something acceptable”.

This time, instead of becoming a landlord, you’re considering selling out.

What’s it going to cost you to get there?

Agent’s Fees1

Capital Gains Taxes

Moving Costs

Refurbishment Of New Place

Hassle

…plus the risk the move makes no improvement to your life.

What I mean here…

Moving requires energy.

Might that energy generate a better return if applied somewhere other than tweaking your living situation?

If you sell then you’ve taken a fixed expense (mortgage, taxes, insurance) and turned it into a variable expense (rent).

OR

You’ve moved from living in a “known” asset (your current place) to an “unknown” asset (where you end up).

Each time we change strategy, we give error an opportunity to enter our lives.

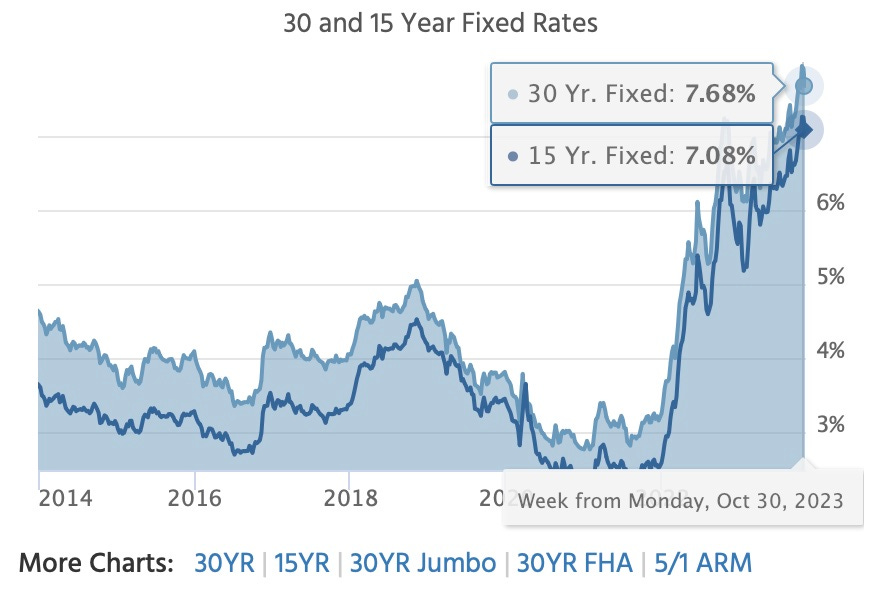

A long-term fixed-rate mortgage is an effective inflation hedge, particularly if you’re locked in at a low rate.

Deferred Taxes & Fees

Deferred taxes are an interest-free loan from the government, and you decide when you pay them.

Within the portfolios I manage, I have a line item called deferred taxes. It is the tax liability (mostly capital gains) incurred if the entire portfolio was sold.

Sell everything today, at market, what’s the tax bill?

For real estate, I add a line item called “deferred agents fees.” A large item, as it’s paid on the gross asset value.

So, in the balance sheet, there is an item called “Deferred Taxes & Fees.”

Whenever I’m thinking about recommending a sale… I ask myself,

Do I really want to repay this interest-free loan?

Is the alternative use of this capital so much better it makes sense to swap out?

Is it worth the hassle of selling?

Will “my life” (or the beneficiaries lives) actually get better as a direct result of this sale?

You want to make the hurdle challenging. A few times, the answer has been “Yes, definitely.” In those cases, it made sense to change strategy.

But mostly, I look at handing over all that money to the government and decide to wait. It doesn’t mean I’m deciding not-to-sell. It means I’m postponing the decision to a later date.

Delay provides more time for compounding to benefit the portfolio.

Even a debt-free portfolio has leverage from “deferred taxes & fees.”

As much as possible, never interrupt compounding.

This logic works with investment real estate, too. It’s not easy to find great locations. When you find one, you probably want to hang onto it.

Whenever I consider purchasing a property, I assume 10% of the gross purchase price is written off on Day One. This is a mixture of: margin of safety, fixing hidden liabilities, time/hassle if I wanted to exit quickly and agent’s fees if sold immediately.