Defining Success

Every parent wants their kid to be successful.

These discussions have an embedded conceit. Each generation, each individual, must decide on their own definition of success.

Further, I promise you:

Your parents passed their unfinished dreams to you.

You have passed your unfinished dreams to your kids.

It’s there.

Look for it.

Acknowledge it.

I have watched my thoughts on “winning” change across each decade of my life.

Go a little further…

Am I successful?

What do my actions say about my values?

Can I write down my definition of success?

Years before college discussions.

Years before career discussions.

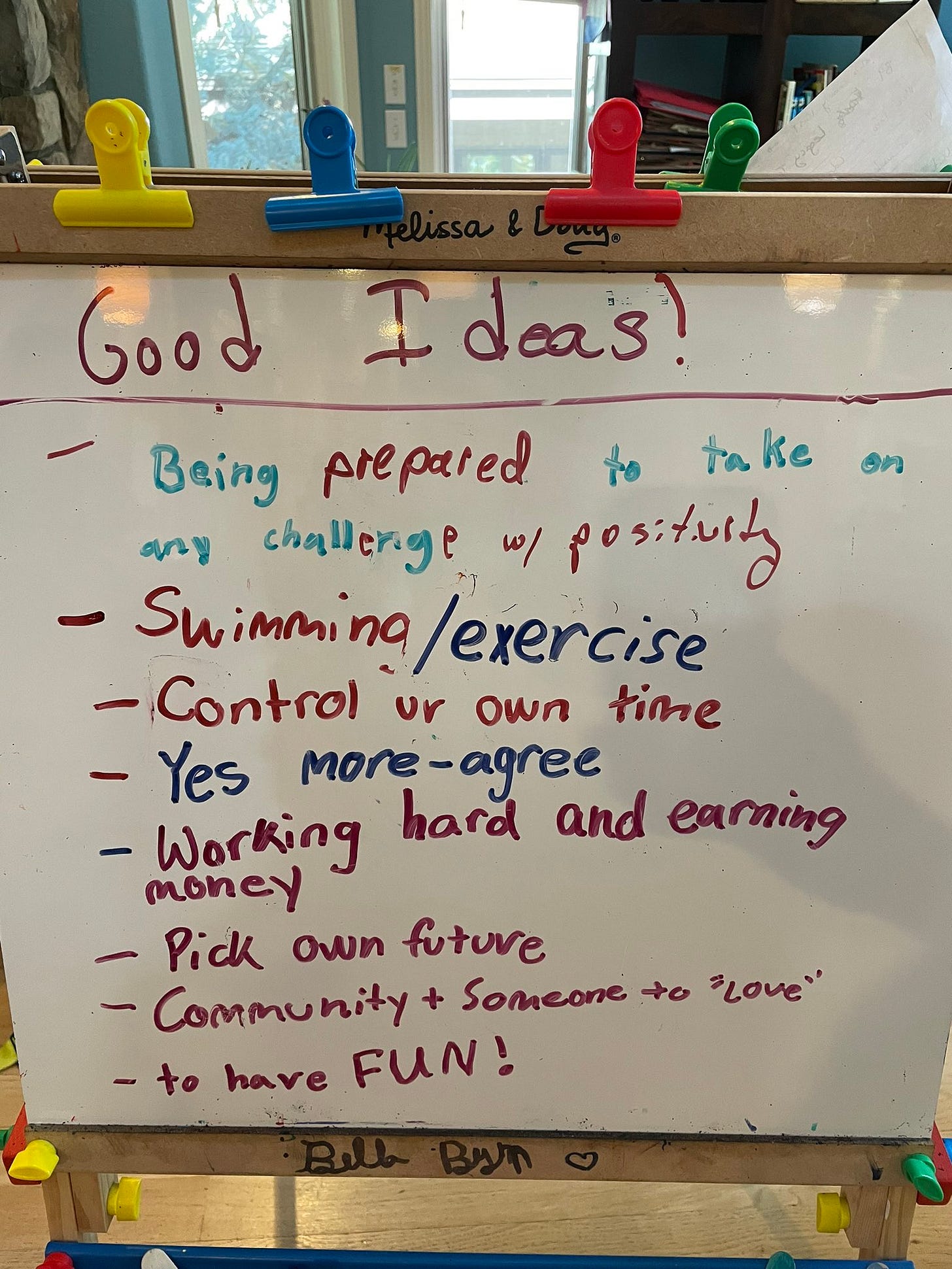

Make time to talk about values.

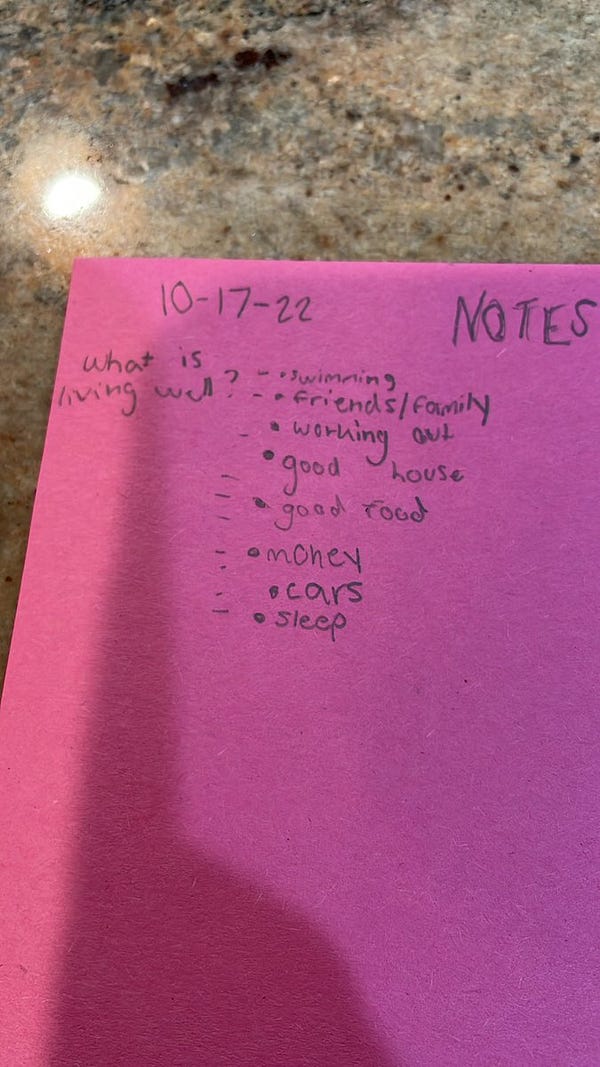

Start with a simple question:

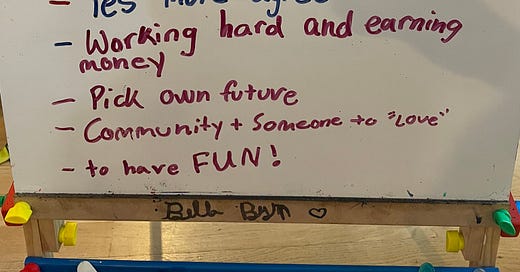

What is Living Well?

There are no wrong answers. The idea is to pause and consider the question.

As a leader, I start with myself. My kids pay the most attention to the choices I make.

Money, and success, are addictive.

Don’t set the next generation up for a lifetime of consumption.

Education Matters

The most useful part of my degree wasn’t finance, or economics.

It was financial accounting, programming and mathematics.

I learned fundamental knowledge in college.

I learned my profession on-the-job.

We learn by doing work, for the best people we can find. To help your kids, apply your TIME to expose them to the best people you know.

But you’re short on time.

Perhaps, you are focusing on the wrong variable => money.

Part One explained how to reduce the family financial burden.

Below, I explain how to reduce your financial burden.

Creating Happy Savers

I ran the numbers on Michael’s bank. It’s a bit aggressive for our family.

By the time the kids graduate, I would be on the hook for $6,000 per kid, monthly.

Our version of Michael’s game:

$1 per birth year each Monday.

$10 per week, for a 10-year-old.

Kid can save on top.

Bank of Dad pays 10% APR.

Below, the game if the kid saves their allowance.

We’ve been playing for ten years.

Not much happens at the start.

That’s OK.

All it takes is one kid to figure out compounding. They will teach each other and become VERY interested.

The purpose is to build an EMOTIONAL attachment to compounding.

Give the game years to play out.

There are two types of spending from the family account.

Investment Spending – if the money came from “the bank” then spending approval needs to include Mom & Dad, or another savvy adult.

Earned Income Spending – Mom & Dad have no veto rights over money the kids earn on their own.

This structure mirrors the world the kids will enter.

Business Spending / Multi-Generational Capital Allocation - Governed by Investment Committee

Personal Spending & Investment - Governed by Personal Choice

Lending to friends, pain of crappy impulse purchases…

Let mistakes happen.

Let kids feel the pain of poor choices.

Share stories of your own errors.

Teaching this to your kids, and grandkids, will change your relationship with money1.

Be patient, the goal is an emotional attachment to compounding.

Make it happen.

Recap

Part One explained how to align incentives and save millions for your family:

Debt Free Education

The True Cost of Debt

Role of Education

Then I laid out a game that will cost you $15,000 per kid and place them on a path to financial independence.

The game:

Creates An Immediate Positive Feeling with Saving

Makes The Power of Compounding Real

By reducing your financial obligations, you make it easier to spend TIME with your family.

Part Three: Work Ethic, Adversity, Allocating Time

Here’s a Dropbox PDF and a link in Google Docs.