Kids and Money, Part One

Work Experience, Debt-Free Education and the Hidden Cost of Family Debt

Before we start, an introduction for new readers:

1990 - graduated McGill University, 1st Class Honors, Economics and Finance

A decade in private equity (Permira), was the youngest partner in my firm when I left in 2000

2000 - used my skills to help a friend start a property investment group

2005 - got spooked by the easy-money environment, friend wanted to ramp up, I sold down

2008 - turned 40, wrote off considerable (paper) wealth in the start up

2023 - Fiduciary for a small family office & President of a Private Trust Company

My Dad’s been in finance longer than me. Chartered Accountant then Harvard MBA, class of 1975, Baker Scholar. Followed by a long career in banking, venture capital and private equity.

We’ve seen a lot.

Michael shared a thread that I’m going to use as a template.

Applying this advice will create enduring wealth for your family, and will free time for you and your spouse.

More than financial wealth, time is where I think you should focus. We will cover time, in Part Three.

Work Experience

Our approach:

Incentivize Work

Incentive Savings

Let Kids Be “Poor”

The most-productive members of our family worked from a young age. Sometimes for the family-businesses of my great- and grandparents.

There’s been money in my family tree. Occasionally, lots of money. I have elders who didn’t need to work. Generally, not-working has been a disaster, for them and their kids.

Our oldest has been earning her own spending money since she turned 12. I graduated from high school, and college, with money in the bank.

For a kid, I don’t think earning capacity is important. What matters is the experience of working, earning and saving.

I like Michael’s tip, working non-family jobs tosses up real-world issues that we discuss at home. Our family businesses are long sold, and the proceeds spent by my ancestors.

Debt-Free Education

Debt-Free Education leaves incentives intact.

Putting a kid on the payroll to “follow their dream” does not.

The reasons I graduated with money in the bank:

Scholarships & Awards - I did well

Tutor, Teaching Assistant & Summer Jobs - I worked

Dad and Granddad subsidized living expenses - Family helped

Tuition Was Cheap - C$1100, per annum 1986-1990

A family goal of debt-free education:

Aligns the incentives between generations

Is a multigenerational project

Requires each generation to contribute

This project can add value to the entire family system.

The True Cost of Debt Is Hidden

I’m going to explain how families routinely blow millions and think they did the right thing.

Every market juiced with easy money gets screwed up. American higher education has been juiced, for a long time.

I googled up average debt at graduation and average graduation age.

$40,000 and 23 yo.

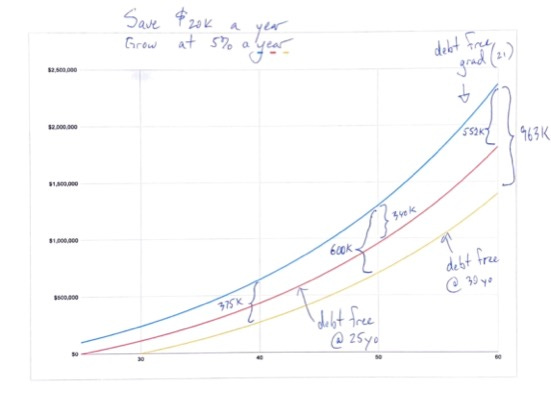

So let’s make three simple scenarios:

Debt free graduation (21 yo) => McGill 1990 finance grad

Debt free at 25 yo

Debt free at 30 yo

Let’s run it forward assuming:

Investment return of 5%

$20,000 saved each year

The late-start saver

who saves at the same annual rate

who earns the same return

ends up ~$1 million behind at 60 yo.

Debt-free education, in a field that earns, is a better legacy than money when you die.

This is not the whole story.

In my demographic, families burn ~$250,000 of capital to help a kid “get started” => 529 accounts and parental support.

What’s the 30-year cost of this choice?

$250,000 * (1.05)^30 = $1,080,000

Million bucks gone, you never see it.

You burned the capital

The kid figures life out by 30, and spends most of their 20s pissed at you (for tapering their support)

$2 million opportunity cost, spread between two generations.

Too often, we assume an expensive education is what we are supposed to do.

A possible alternative…

Our default position is in-state education and I’ll buy whatever’s left of your 529, at $2 on the dollar, once you save $100,000 of your own money.

What do we want to have happen?

Conserve Family Capital

Build A Habit of Saving

Use Debt Sparingly

Don’t let anyone borrow until they’ve demonstrated the ability to earn, and save.

In Part Two, I will explain how to teach earning, and savings, to your kids.

Every adult pays their own way.

Incentivize Savings

Above, Michael recommends we “save like mad.”

That’s exactly what I did. From 1984 to 2008, I banked 50% of every dollar I earned.

Changed my life.

In Part Two, I’ll explain how to build an positive emotional association with savings.

Delayed gratification does not work.

You must create an immediate payoff - for yourself, and your children.