From 2000-2008 I built a capital reserve with the idea of buying a family vacation property.

We researched great locations: beaches, islands and mountain towns.

The closest I came to acting on my dream was buying several Tucson condos. Due to the Great Recession of 2008/2009, the condos were bought at less than 50% of replacement cost.

When my wife visited Tucson, she told me the town wasn’t a good fit for her. Three kids later… I exited those deals at a small profit.

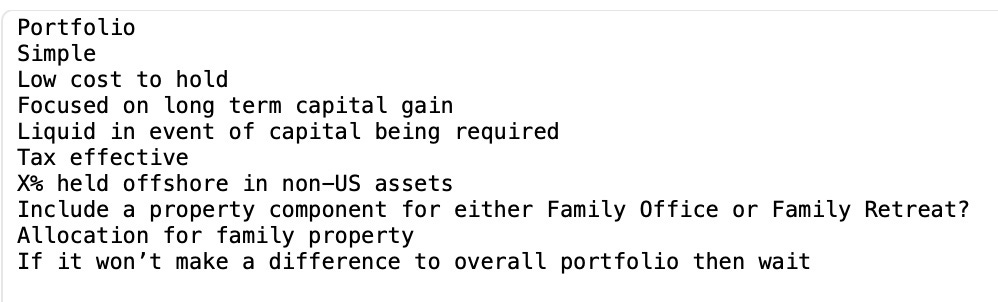

Family Investment Strategy

Successfully investing family money is different than the business model of investing other people's money.

I wrote the above many years ago.

The list is a good summary of what I’ve learned from 30+ years of finance. I come back to it whenever I’m wondering what-to-do.

I want to highlight three lessons. The lessons will save you time, energy and emotion.

If it won’t make a difference then wait.

If you’re unsure then wait.

Every new decision introduces the possibility for error.

Most investors waste energy thinking about topics that have NO bearing on longterm results.

Most minds are distracted by noise.

Will this make a difference?

No? Reject immediately, and get back to living.

Yes? Clear the decks and have a look.

In my mid 50s, there are very few things that will make a difference.

I will talk about two below.

Am I sure this is a good choice?

No? Postpone. Choose Later.

Yes? Act decisively.

This filter means:

Fewer Decisions

Better Decisions

Less Error

It makes my portfolio boring, with little churn.

Less action means I am paid in time, which is more valuable than money.

My Financial Life

What’s my role?

Model Spending

Execute One Good Idea A Year

Execute One Great Idea A Decade

Kinda boring, but that’s the reality of prudent financial management.

The time NOT spent on…

Things That Won’t Make A Difference

Considering Marginal Opportunities

Churning Assets…

…goes into building Human Capital.

Specifically, educating my peers and the younger generation.

2023

The “trouble” with being financially prudent is vacation properties never stack up.

Because I’m always “unsure,” I always wait.

While I’m waiting, another deal comes along that looks WAY better than a 30-year old vacation condo at $1,000 per square foot.1

In 2023, that deal was a downtown house purchased at a discount of $500 per square foot versus replacement cost. The implied discount covers my family’s cost of living for ~4 years.2

One Good Decision A Year.

A year ago, I thought there was ZERO chance of being able to buy well. I’d lost hope of doing another good deal.

But…

We were patient.

We kept looking.

We were able to act decisively when opportunity arose.

+++

Then disaster hit in another part of the portfolio…

The property I wrote about as Life Insurance flooded.

It was a slow motion disaster. The tenants were away, a toilet broke and thousands of gallons soaked the house.

At least $50,000 worth of damage

Months of lost rent

Unforeseen expenses

Hours of my time

Once the dust settled, an opportunity.

I had been unsure whether to redevelop the site…

Following my own advice, I’d delayed the redevelopment decision, twice.

The house had reached the point where maintenance expenses were eating up all the rental income.

The vacancy rate was creeping up.

Time made the decision for me.

Rather than repair, time for a remodel.

A lesson I continue to re-learn.

Often, we feel a desire to force a decision. Unless the deal is screamingly obvious, I’ve always achieved a better return on delay.

Time - Energy - Emotion

Direct all three with intent.

Link is to my article on Vacation Real Estate. That market continues to climb.

I convert Wealth To Time.