Part One introduced Core Capital.

Part Two expanded the definition to include time and human capital.

Parents have three important transitions in their lives:1

Household Expansion - arrival of kids

Household Contraction - departure of kids

Time Horizon Contraction - a shrinking number of years to finance

Successfully navigating these transitions requires a different approach from what worked in the earlier parts of our lives.

The first half of our lives is largely self-discovery.

The second half of my life has been about considering what’s best for my family.

Think carefully about the capital you’ve built so far.2

Try to adopt the mindset of your future self.3

Study similar, older peers.

Ask about their best decisions.

Learn from their regrets.

Learn from the approach of engaged elders.

What do they enjoy now?

How might I position my life for similar benefits?

The above sounds good. What does it mean in practice?

Have friends older, and younger, than you.

Parents of my close friends.

Coaches 10-15 years older than me.

Clients 15-30 years older than me.

Senior Partners 25-40 years older than me.

Watch them and listen to what they say.

Everyone we meet is an interesting case study.

The question being,

If I continue down this path then where am I likely to end up?

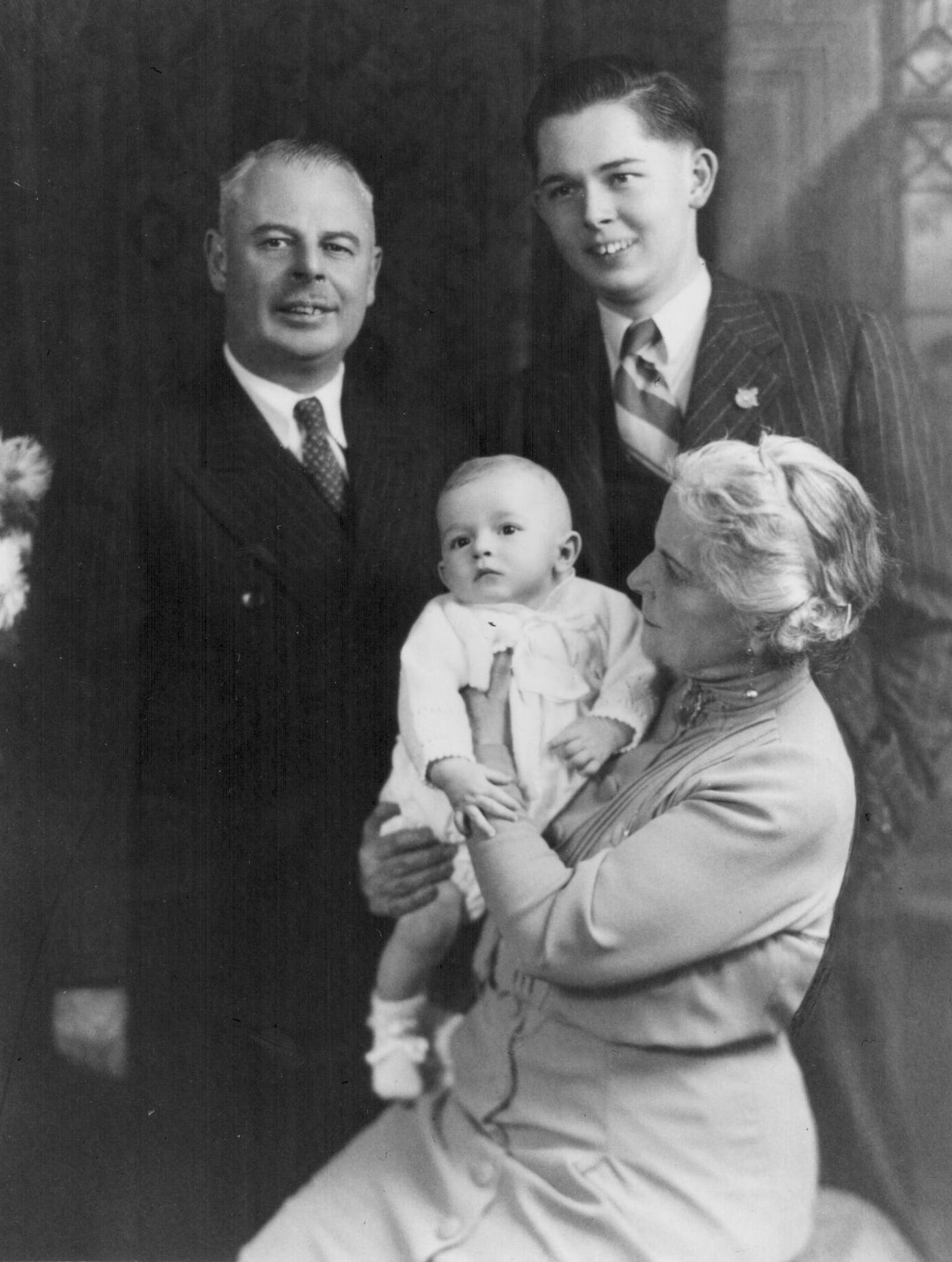

At the birth of our first child (2008), I didn’t have a clear idea about where I wanted to be 15 years later.

I had a clear idea where I didn’t want to end up. Divorced, again.

By avoiding poor choices, I made good choices and ended up madly in love.

It’s the Charlie Munger approach to family systems, “be less stupid.”

Expanding Households

Act as if the following is true:

Living with toddlers will be the most stressful period of your marriage.

Within that period, act as if your #1 task is the following:

Get through with our health & marriage intact.

I figured it would take me a couple years to get through the tough bits.

It took a decade.

Here’s what I learned.

First, I was grateful I worked hard early in my life.

Second, learning how to spend wisely served me well.

This was the strategy:

Pause capital accumulation.

Focus on reducing stress within the marriage.

Create time:

To Have Fun Together

To Exercise

Time - Together - Exercise

Within the strategy, we used these tactics:

Downsize our home.4

Weekly bits of space, rather than large trips.5

Create work to engage with favorite activities (coaching).6

Reducing choices that took us apart.7

…and what did we spend our money on?

For ten years:

Childcare - to create time for each other, weekly.

Preschool - to help our kids learn how to get along with each other.8

It was money well spent.

When we downsized, we bought a house a half a block from a public elementary school. Live close to the school is an effective time saver.

Geographically, this was a relatively stable time in our lives. We settled into Boulder during my wife’s first pregnancy and stayed put.

Contracting Households

I’ve lived in North America, Europe, Asia and Oceania - multiple cities within those continents.

Here’s what I’ve learned:

If you are living somewhere you expect to leave then go.

Where should you go to?

Live Where You Don’t Need To Leave

How’s this principle relevant to kids growing up?

If you choose wisely then you’ll position your family for multigenerational success.

Old Money understands this point.

But it’s not about money, it is about YOU.

As you age, your definition of success will include having your family nearby.

You’ll want them close, but not too close.

You have time to figure this out. I left Hong Kong as a 31 year old and didn’t land in my long-term location until I was 39. I’m not near my family, but I am near three generations of my wife’s.

Here’s the key point,

Get yourself to where you want to be, before you need to be there.

I got myself to my empty-nester hometown before my kids were born.

Over the years:

I came close to relocating the family to California9

Purchased out-of-state property

Eventually, decided good enough was good enough

Sold the out-of-state property

And here we are 15 years later

A little bit about my decision not-to-move.

Choose - get somewhere that’s going to work

Change - adjust my attitude

Persist

Colorado ticks a lot of boxes, but so do many other places.

For me, the key ingredient was attitude.

Being Local

My wife grew up where we live.

Proximity

Community

Having three generations of her family within driving distance is a lot of travel avoided, and informal contact experienced.

Proximity’s benefits are mostly invisible. My wife’s family doesn’t see them. Having managed my grandmother’s end of life care, from a different country, I know the value of proximity.

Proximity has proven valuable when life cycle events have happened (deaths, health emergencies).

Community is valuable all the time, not just when setbacks occur. Building community takes time, and effort. My ancestors had more than 100 years of community in Canada.

The sooner you get to where you want to be, the sooner you can start building community.

Having your kids grow up where you plan to grow old is valuable to your future self.

I didn’t consider these points as a young adult. I realized their value, when I noticed their absence.

Making It Work, Locally

Having moved frequently in my 20s and 30s, I developed a moving habit.

In my early 40s, I continued to leave town, frequently, while living in the same place.

Similar to realizing my spending wasn’t buying me anything, I asked…

What’s all this travel doing for me?

Being able to ask the question of myself, I went further.

What does the travel do for my marriage? my kids?

I realized my travel was an avoidance strategy to deal with the challenges of family.

That process took years and the end result was a decision.

Make it work, right here.

I decided to take all the energy, and money, spent on travel and invest it into making my local life better.

Not just me.

Make the entire family’s life better, locally.

My decision not to leave was driven by a desire for my kids to have ties to the place where I plan to live the rest of my life.

We have spent their childhood sharing happy memories all around Colorado.

While I made the choice to leave Canada, my family has an option for multigenerational stability.

Time Horizon Contraction

Investments that made ZERO sense at 40, look differently as I approach 60.

The next installment will cover asset allocation later in life.

My mindset has changed in ways I didn’t expect.

If you have kids “young” then you are likely to have a 30 to 40-year block of time when they are grown. Time enough for two, or even three, additional careers.

The section on Wealth In Time in this article gave me the courage to cut spending that was buying me nothing. Pruning my spending has been a lifelong task.

Specific advice on this “future mindset” is contained in my free eBook, Live Long & Prosper.

Less cost to operate, less capital invested, less TIME to take care of it. It was a five-year process to get out of our Dream House.

I refused to spend a lot of money getting myself tired in a way that didn’t directly benefit my marriage or my health. If I was with all of my kids then I wanted my wife exercising, or spending time with her friends.

What is the “Net Cash Flow per day” you need to travel away from your family? The Money Value of Time will help you figure it out. To have the life you want, learn how to give a “nice no thanks” to attractive opportunities.

Money, marriage, health => the lessons of high-performance sport applied to a family system.

From my archive blog. A Million Dollars of Education. Too many parents spend a lot of money on their kids at a point where it has little impact. Our choice was to front end the investment in time, and money.

Take references before making big decisions. Part of the reason I didn’t move to California was half of my friends living there wanted to leave. I found this out by scheduling a series of calls and listening to what they were really saying.