A reader asked…

Wondering if you can share some guideposts or insights on how to quantitatively/qualitatively evaluate when the side gig becomes the main gig.

I think about your finance career and how that pivoted to the world of endurance athletics.

Freeing ourselves from needing a “main gig” is an underrated objective. It took less money than I assumed and retirement isn’t all it’s cracked up to be.

I freed myself by applying the strategy in the Core Capital section of the index.

It took me ~12 years to put everything in place.

The pay off was earning self-directed time.

This time arrived at an age when I had the energy to get a lot done.

1,000 self-directed annual hours is different at 35-55 than 65-85.

The strength and vitality of youth is hidden from our younger selves.

..but I know what you’re asking. You want thoughts on when it is safe to step away from traditional third-party employment.

The starting point is a deep dive into your (family’s) current position.

I normally write this as a series. The idea is to reduce its overwhelming nature to the first-timer. This time, I’m going to put everything into a single article. I’d encourage you to grind through. It gets easier as you repeat the review. After you’ve done the review, save everything so you have a template for the following year.

This template has helped many families gain comfort about the direction they are going. If your spouse is a nut about money and spending then this review is something you should do together. I’ve acted as a facilitator for families who find the process emotionally charged. If one, or both, of you freaks out about money then have a trusted, calming, advisor walk you through it.

Even if you don’t change a thing… taking a close look will leave you with a feeling of control and purpose.

Building a feeling of Control and Purpose is how you support an anxious spouse.

Set Up

The picture (top of today’s article) is what it cost to send a first class letter when I married my lovely wife. The 73c cost today (+78%) is a reminder that inflation ticks away one penny at a time.

When it comes to inflation/deflation, I maintain a neutral position. More broadly, I avoid the need to pick winners. Pay attention and you’ll find your losers hurt you more (emotionally) than your winners cheer you up. We can smooth the emotional ups & downs by getting things broadly correct and paying less attention to short-term movements.

I avoid making predictions about an unknowable future. Most importantly, because it’s impossible (!) but also because I have no idea what my life is going to be like ten years from now.

The future we think we are preparing for is likely to be completely different than what we expect. Confirm that statement by looking backwards 10, 20 and 30 years and asking the smartest older people you know to do the same.

With an unknowable future... we start by taking stock of the present.

Quantify Your Net Annual Surplus

Start with your core cost of living – that’s what’s going to inflate, or cause a cash flow crisis.

What is Core Cost of Living?

Healthcare (premiums, HSA contributions and deductibles)

Taxes, Utilities, Car Costs and Insurance

Food, Clothing and Kid Activities

Childcare – a massive line item from 2009 to 2019

Mortgage, rent, car loans – my main project from 2010 to 2020 was getting this down to zero

Everything we gotta pay - essentials

Next, consider Sources of Passive & Active Income. Rents, royalties, dividends, interest, consulting and any other forms of income. Write it all out.

Compare Core Cost of Living with the Sources of Income and calculate your net burn rate, or your net annual surplus.

Net Annual Surplus is allocated towards:

Discretionary Spending - Nice To Have

Luxury Spending and/or - Don’t Really Need To Have

New Investment Capital - Buying Future Time

The best investment decision I made had nothing to do with asset allocation.

From 1990 to 2008, I routed 50% of my gross income to new investment capital.

In my early 20s – healthcare costs were peanuts, I had no kids, I was living in a shared apartment… I saved a ton. Good thing, too. I had no idea how much my cost of living would pop when I had kids.

My 40s (2009 to 2018) saw unexpected unemployment combine with a big jump in childcare, healthcare and housing costs. This resulted in a burn rate that forced us to make a series of changes, and choices, which proved quite useful in hindsight.

Being forced to make choices due to tight cash flow is extremely valuable. Sequestration should be built into all levels of government and the public sector.

Write Out Your Balance Sheet

Two column chart.

Assets on the left

Liabilities on the right

Include a liability called “deferred tax and agent’s fees“. Estimate this liability as 6% of the gross value of all the real estate you own plus 25% of all the capital gains in your portfolio (exclude the exempt portion of the gain on your primary residence). Making this number real will help you avoid incurring unnecessary expenses by tinkering with your assets.

The best time to sell great assets is never.

Let it roll.

Winning

Let’s pause. In a minute, we will use the data you prepared above. Before we get stuck into the numbers, let’s step back.

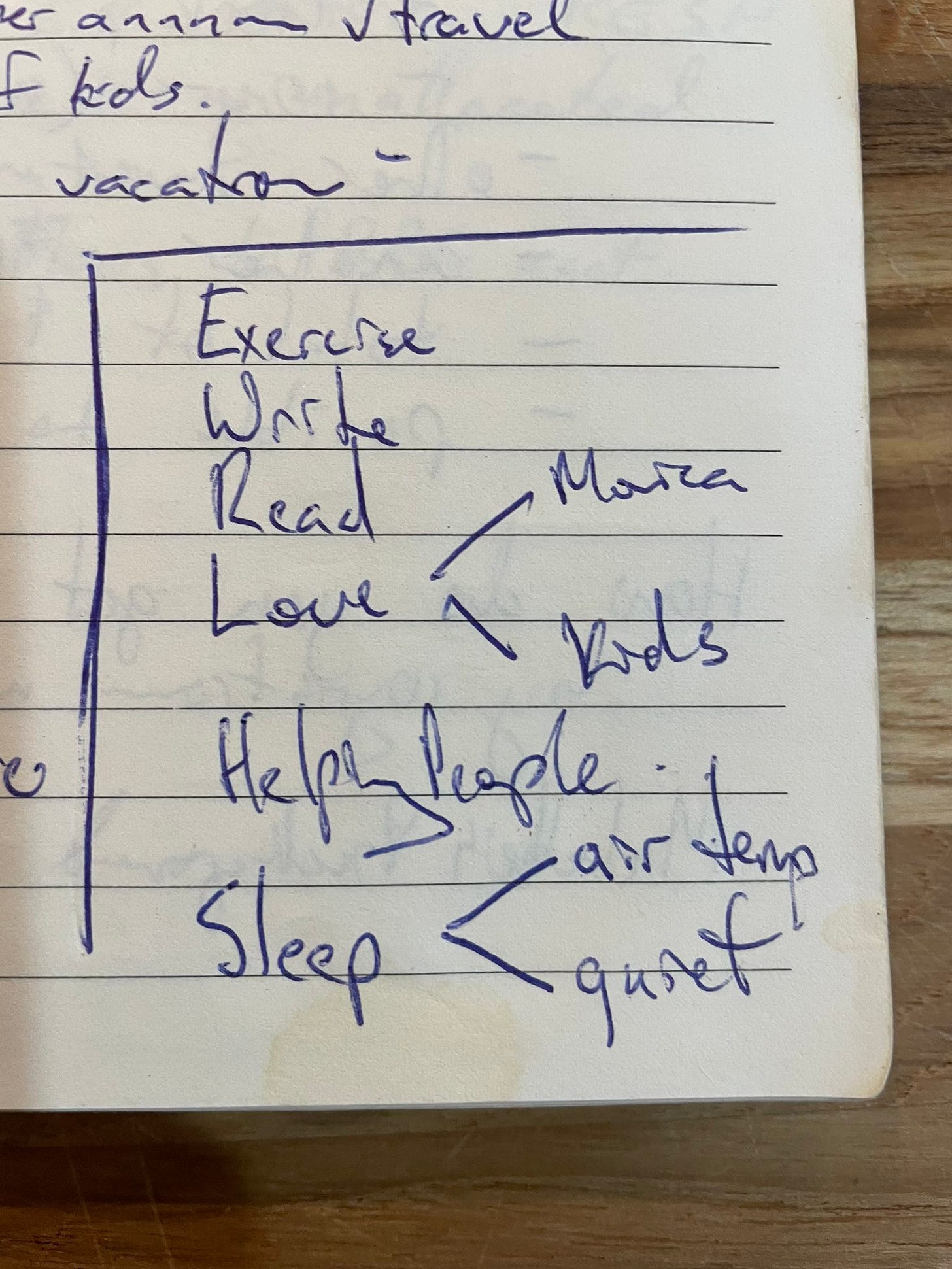

In my Kids & Money Section you will find a template for a discussion on What is Living Well? The discussion is for adults, too. In fact, I need constant reminding myself.

My game is NOT won by building income, assets and spending.

Every choice made to appear rich reduces family wealth.

My wealth game => increase discretionary time while getting the net burn to zero.

I am willing to wager you will not feel free, or serene, until you get close to that point.

“That point” being where you can sit back and not care about the ups and downs of the world. Being able to sit with equanimity will improve your thinking, and your relationships.

Net Burn to Zero

Sit Back with Equanimity

A simple form of wealth, achievable by most.

It’s going to take a while to get there. Here’s something I wrote in 2016 about the process. I chipped away for decades and am a better man, on a smaller balance sheet.

Each time you get an attractive opportunity to lock in a piece of your core cost of living, take it.

Philosophy of Status

Don’t think I have transcended the human drive to compete for status.1

What I’ve done is (try to) channel it away from external approval, virtue signaling and consumption.

Needing a place to allocate this drive, it goes into my writing, marriage, quality of thought and daily actions.

For a long time, my drive went into endurance sport.

Endurance sport is coming back:

Because I love it.

To set myself up for a functional old age.

Being in outstanding shape is a flex that requires no explanation.

Redirection is a whole lot easier than transcendence.

Scale Your Financial Wealth

Back to the numbers… I recommend you look at things a few different ways. Print this out and write your numbers on the page.

Make it real, especially if you’re financially fearful.

Gross Assets / Core Cost of Living = years

Net assets / Core Cost of Living = years

Net Assets / Net Annual Surplus = years

Net Assets / Net Annual Surplus (excluding active income) = years

Cash / Core Cost of Living = years

Cash / Net Annual Surplus = years

Cash / Net Annual Surplus (excluding active income) = years

Cash / Gross assets = percentage

Cash / Net assets = percentage

I include bond holdings in cash. I focus on the BOLD, while considering each line.

Gross vs Net makes it obvious if you are over leveraged.

Removing active income shows how reliant you are on your current job.

Looking at cash versus different metrics gives you an idea on how long you could last in the event of a big shock (illness, unemployment, a market where you didn’t want to realize assets).

Armed with the above, you can get a feel for how much time is available, based on how you are living today.

It’s easy to get fixated on income/spending and lose track of time.

The best investments I have made involved trading money for time.

When I assess new projects, I consider the time required and the financial return as a multiple of current spending.

In competitive sport, I recommend serious athletes gain control of their mornings. This is because it doesn’t take much time to greatly increase the quality of our personal lives. As a triathlon coach, I’d get my athletes to carve out one weekday morning per week where they’d start work late. Maybe your passion is golf, or some other activity.

When I was working like a madman, I didn’t have the mental capacity to consider alternatives. I had to take a two-month sabbatical to give myself space to figure out who I wanted to be and the life I wanted to create. Even then, when I decided to take a one-year leave of absence, I had no idea what the future would hold.

The first morning you carve out will have the greatest utility.

Long Term Financial Strategy

Discretionary/Luxury Spending – falls outside of our Core Cost of Living. My advice here is “pay yourself first” – slice your investment program off the top of each paycheck before you spend it.2

Don’t borrow money (personally) until the first credit crisis after your 30th birthday. Then, borrow modestly to purchase real assets, priced down due to a banking crisis.3

Across the 40-50 years of your working life, you will not miss luxuries not purchased. You will miss the strength, vitality and energy of youth.

As for overall strategy, there is a useful PDF here. As the PDF will explain, beware of those who profit from complexity.

Consistency As Protocol

Focus on what matters:

Spending vs new capital saved,

Learning to think in time, not money, and

Good enough is good enough (low cost, persistent investment, long time horizons).

The best stuff in my life happens between people – shared experiences with those I love.

People, not portfolios

Where To Focus

It’s easy to get distracted by the noise surrounding our lives.

Ask a confidant… When I talk about money, what do you hear?

With your financial concerns… Am I worrying about the right thing?

Do you know your key risks?

It varies between people and over time => focus on habits that might lead to ruin (leverage, lack of impulse control, smoking, substance abuse…).

Set your financial life so it runs on autopilot.

Things I focus on more than my portfolio…

Near-term: Keep building.

Marriage: Keep my most valuable asset front-and-center of my decisions.

Health: Reduce my risk for cancer and other health issues.

End of Life: Delay dementia.

My actions reflect awareness of the real risks in my life.

My portfolio?

Good enough is good enough.

Avoid unforced errors and keep on keeping on.

I hold my actions up scrutiny and own my say-do gap.

A favorite quote from the Tao Te Ching… “the man who competes with no one, in all the world, has no competitor.”

The best way to deal with doomers and pessimists is a relentlessly focus on self-improvement… “I hear what you’re saying but I just don’t see the decline you’re talking about.”

One of my side gigs lost money for years. Finding myself unexpectedly unemployed, I wanted to turn the business around.

I changed pay-yourself-first to pay-my-spouse.

I set myself a cash generation goal of $4,000 per month and paid it into my wife’s bank account. By keeping my side gig “short on cash” I maintained the pressure to generate cash flow for my family, rather than “allowable expenses” (for myself).

Coming out of the Great Recession of 2008/2009, it was near-impossible to borrow. The blown out prices (of 2010) made great deals for cash buyers. Since 2010, I’ve adjusted strategy once. I bought the dip at the start of covid. There’s a lot of waiting involved in successful investing. Good enough is good enough. Live your life.